Running your business is made easier with streamlining your financials using QuickBooks Online, so think of moving to the cloud. One of the first things to consider is whether you are registered for GST here Lauretta walks you through some Tips when setting up you new business QuickBooks Online account.

Tip 1

If you’re not registered for GST, DO NOT set up GST in the GST Centre from the left-hand-side navigation bar.

This will save you a great deal of time having to enter the Out of Scope (No GST Reportable) GST code for all transactions.

Tip 2

If you have set up GST and you are not registered, you can default the code from the company preferences to OOS (Out of Scope).

From the Gear Icon, click Settings, then Company Settings, then Advanced, and then Default tax rate selection.

Tip 3

GST needs to be set up correctly from the initial set-up.

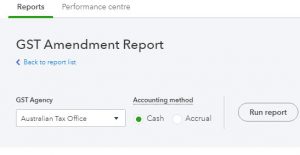

If you’re unsure, ask a BAS agent or your accountant. I’ve seen many set-ups of GST that have ended up with BAS underpayments as the GST method was set as either Accrual or Cash incorrectly.

Tip 4

Ensure all your bank and credit card accounts have been reconciled.

EVERY business expense, payment, sales payments, sales receipts, cash expense, payment and sale should be posted in QuickBooks Online for the BAS period.

If this has not been completed, you will not pick up all the correct business transactions that you can claim and you may miss out on credits on your BAS. This is especially important if you are on the Accruals GST method. This also means you could miss out on payments for your services and on GST collected and you will have to pay this back at some point.

Tip 5

Upon completing your BAS in QuickBooks Online, remember to click the Mark as Lodged button in the ‘Completing a BAS” window.

This will save a snapshot of your lodgement and generate a BAS Journal to reduce the BAS liabilities account in the Balance Sheet and moves the amount to be paid or refunded into the ATO Clearing account. This will also close the BAS period and any changes made to the transactions from this period, and prior periods that are changed later will be shown in the GST exception report.

The transactions in the exemption report are then shown in your next BAS period in the Complete BAS worksheet under the Exception Amount. They will be added or subtracted to the GST on Sales or GST on purchases amount and will be reflected on the bottom figure of Refund or payment due. These figures should be reported to the ATO for this new BAS period.

Tip 6

Installment Activity Statement or IAS Reporting – Monthly reporting for PAYG.

The PAYG Tax withheld total salary (W1) and Amount withheld (W2) in the BAS Summary and BAS Completed worksheet is picked up from the journals created upon completing a payroll. See below for a completed pay run journal:

FYI: W1 and W2 refer to fields within the BAS Statement, the term is quite familiar to any GST registered business.

QuickBooks Online will push through the amounts from KeyPay Payroll from your payruns of your employee wages, this will have the total amounts in both W1 and W2 for the entire quarter.

Tip 7

Enable BAS E-lodgement for QuickBooks

Connecting QuickBooks Online with the ATO will create a direct link to lodge your BAS, but the ATO can only access what is lodged with them directly.

Benefits of connecting QuickBooks to the ATO for e-lodgement include:

- Automatically import Income Tax and Fringe Benefit Tax Installments

- Lodge IAS and BAS directly from QuickBooks Online

Read more here How to enable your e-lodgments from your BAS Centre

Post comment

I have a client preparing his GST in a spreadsheet and not in QBO. The last GST prepared on QBO was in 2019, and I would like to start organising and controlling the lodgement in QBO from March 2023. How can I change the Lodgement period? The next lodgement period is Jul-Sept 2019.

PermalinkPost comment

Hi Alba

Permalinkbest way to go around this is if you have your QBOA access UNDO the BAS that was completd in the BAS Centre in 2019 and then your able to start the first lodgement in QBO from the March 2023 Lodgement. TIP you will need to clean out his GST and PAYG control accounts to match what is owed for the March BAS otherwise your control accounts will never go to $0.00. Hope that helps